News you can use...

Recent Updates

- #35 TDS on Free Samples, Perks & such other benefits – New Section 194R of Income Tax Act, 1961.

This new provision is as below:

Any person responsible for providing to a resident, any benefit or perquisite, whether convertible into money or not, arising from business or the exercise of a profession, by such resident, shall, before providing such benefit or perquisite, as the case may be, to such resident, ensure that tax has been deducted in respect of such benefit or perquisite at the rate of 10 % of the value or aggregate of value of such benefit or perquisite provided during the financial year if it exceeds Rs. 20,000/-.

Where the benefit or perquisite, as the case may be, is wholly in kind or partly in cash and partly in kind but such part in cash is not sufficient to meet the liability of deduction of tax in respect of whole of such benefit or perquisite, the person responsible for providing such benefit or perquisite shall, before releasing the benefit or perquisite, ensure that tax required to be deducted has been paid in respect of the benefit or perquisite.

- #34 TDS on Free Samples, Perks & such other benefits – New Section 194R of Income Tax Act, 1961.

Social Media Influencers, Medical Professionals, Celebrities & Stars who were privileged to receive Free Samples, Gifts, Foreign Trips & any sponsors or benefits will be subjected to deduction of tax at source so that the taxing of these extra benefits earned are traceable. The Person providing such benefits shall deduct tax at source before extending such benefits to any residents of India.

- #33 Did you know!?

In the case of slump sale, the seller shall furnish Form 49 to Income Tax Department along with the Return of Income of said year.

Treatment under GST Act.

As per clause 4(c) of Schedule II to GST Act, transfer of a business as a whole and as a going concern is not considered as a supply of goods. Hence, GST is not chargeable on the assets transferred under 'Slump Sale'

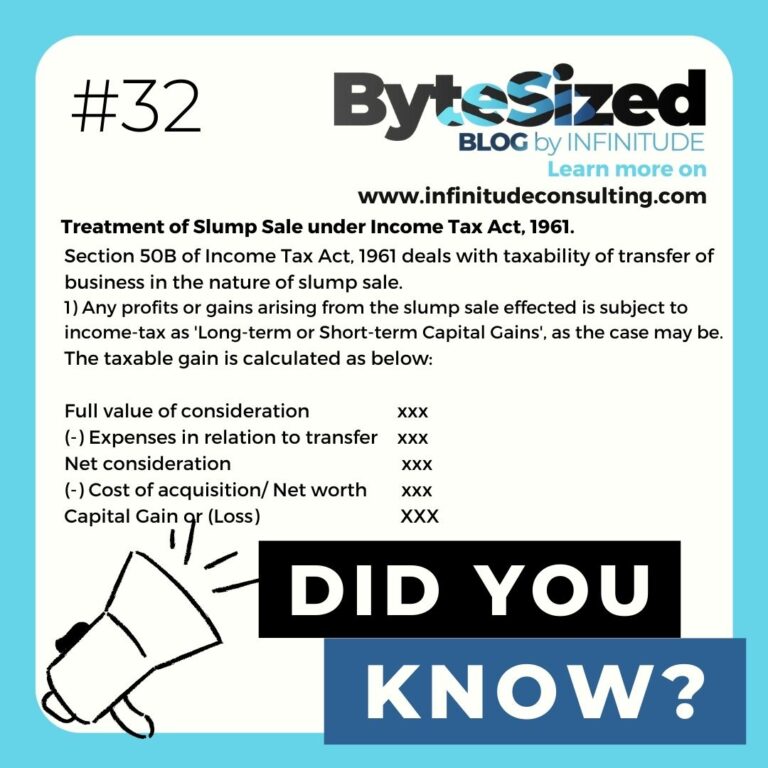

- #32 Treatment of Slump Sale under Income Tax Act, 1961.

Section 50B of Income Tax Act, 1961 deals with taxability of transfer of business in the nature of slump sale.

1) Any profits or gains arising from the slump sale effected is subject to income-tax as 'Long-term or Short-term Capital Gains', as the case may be.

The taxable gain is calculated as below:

Full value of consideration xxx

(-) Expenses in relation to transfer xxx

Net consideration xxx

(-) Cost of acquisition/ Net worth xxx

Capital Gain or (Loss) XXX

- #31 “Slump Sale – A tax-efficient way to transfer/ acquire business”

What is "Slump Sale"?

In simple words, when a business is sold/ transferred by one person to another, as a 'Going concern' for a fixed lumpsum price without considering the value of individual assets & liabilities involved, it is called as "Slump Sale". Slump Sale is very popular practice for it's tax friendly treatment under the tax statutes.

- #30 Did you know!?

AD Code is absolutely essential to the Export process for the following reasons:

- A Shipping Bill is one of the three mandatory documents required for Export Customs Clearance. And, without an AD Code Registration, one cannot generate a Shipping Bill on Icegate (Indian Customs’ Electronic data interchange platform).

- AD Code Registration with Customs ensures that any government benefits you avail of such as, Duty Rebates and Exemptions, GST (Goods and Services Tax) refunds, etc – are credited directly to Exporter's Bank Account.

- #29 Did you know!?

As per the latest amendment to Income Tax Act, 1961, every Trust or Association with 80G recognition shall file Annual "Statement of Donation" with Income Tax Department, declaring the details of donations received during the year via Form 10BD. The due date for filing Form 10BD & issuance of certificate of donation is 31st May of the subsequent financial year. Also, the Trust/ Association shall issue a Certificate in Form 10BE to all such donors specified in Form 10BD.

This notification has been brought up to curb the bogus and fake claims of deduction u/s 80G and to ensure the transparency of the donations received by recognized NGOs.

- #28 Did you know!?

The following are exception from TDS requirement for Virtual Digital Assets:

The consideration is paid by a “specified person” and the aggregate value of the consideration being paid does not exceed INR 50,000 during the financial year; or

The consideration is paid by a person other than a “specified person” and the aggregate value of the consideration being paid does not exceed INR 10,000 during the financial year.

A “specified person” is defined as an individual or Hindu undivided family:

Whose total sales, gross receipts or turnover from the business carried on by him or profession exercised by him does not exceed INR 1 crore in case of business or INR 50 lakhs in case of profession, during the financial year immediately preceding the financial year in which such VDA is transferred that does not have any income under the head “profits and gains of business or profession”.

- #27 Did you know!?

Cryptocurrencies, Non-Fungible Tokens (NFTs) and similar virtual tokens or currencies are considered as Virtual Digital Assets (VDAs). In India, presently, any income earned out of these VDAs are taxed at 30% without the benefit of set-off or carry forward of losses.

If a resident transfers a VDA (Crypto Currency or NFT or the like) for consideration, the person responsible for paying that consideration must deduct 1% of the consideration at source as income tax. The requirement to deduct 1% of the consideration applies irrespective of whether the consideration is in cash, partly in cash and partly in consideration for another VDA, or in consideration for only another VDA.

- #26 Did you know!?

Under the current GST Law, a registered GST dealer, is a recipient of goods or service and fails to pay consideration to the supplier (whether fully or partly) on such supply, the GST Input Tax claimed on such transaction should be reversed within 180 days from the date of issue of the invoice.

However, the reversed ITC can be reclaimed by the GST dealer once the said consideration is paid to the supplier of goods or service at a later date.

- #25 Did you know!?

If you are a trader in goods, you can register under Composition Scheme in GST and pay GST at just 1% on your total sales for the month. Also, Composition scheme gives concession from maintaining Purchase Register since you will not be eligible for claiming Input Tax Credit on your purchases.

- #24 Did you know!?

If you are a partner in a partnership firm or director in a Company or Trustee of a Trust whose Books of Account are subject to Audit, then due date for filing your Personal Income Tax Return will be 31st October of the Assessment Year.

- #23 Who is supposed to have a tax audit in India?

Any person/ business entity carrying business where the total sales, turnover, or receipts exceeds Rs. 1 crore in a year should have a tax audit in India. As a professional, receipts over Rs. 50 lakhs makes you liable for tax audit. Here a professional includes an engineer, architect, and interior decorator, legal and medical professional and any other as notified by CBDT. For the complete list of professionals, you must refer to Rule 6F of the Income Tax Rules, 1962.

- #22 Tax Audit – Audits under Income Tax Act, 1961.

Wonder what is meant by Tax Audit!? Simple, Audits conducted by independent Audit professionals like CAs under the various Tax Statutes in India are generally called as Tax Audit. Audits under Income Tax Act are called as Income Tax Audit or Tax Audits more popularly.

- #21 Research and Innovation Benefits.

Startup India also encourages research and innovation among those, who have an aspiration to be an entrepreneur. Seven new Research Parks are set up across India at IIT Guwahati, IIT Hyderabad, IIT Kanpur, IIT Kharagpur, IISc Bangalore, IIT Gandhinagar and IIT Delhi. These parks will ensure that facilities are provided to students and startups to research and develop their products/ services.

- #19 Relaxed Norms for Public Procurement.

Generally, to apply for Government Tenders (Public procurement), the eligible Vendor is required to have ‘prior experience’ or a ‘requisite turnover’. This would put Startups with requisite innovative ideas, but no long-time established credibility in a disadvantageous position. Under the Startup India scheme, public procurement norms have been relaxed for startups and equal opportunities are provided for both startups and experienced entrepreneurs. This is a big support for Startups with innovative & commercially viable business model to participate in Government tenders.

- #18 Patent Protection under ‘Start-up India’.

In general, Patent Registration is a cumbersome & time-consuming process. However, to ease this process protecting their valuable intellectual property for Startups, a fast-track examination facility of patent applications filed by Startups is enabled under the 'Start-up India' scheme .

A rebate of 80% of the total value of the patent fee is also granted once the patent application is filed. - #17 Business Registration & Single Window Clearance for approvals from Mobile App.

One of the key benefit of 'Startup India' scheme is the option provided to eligible companies to register themselves through a single form. This can be done via Startup India mobile application also. The application has a single form to allow startups to register themselves.

This app further provides startups with single-window clearances for approvals, registrations, filings, compliances, etc. This is the easiest way possible for any one to start a business. - #16 Tax Exemption under the Startup India scheme.

The startups registered under the Startup India scheme & recognized by DPIIT are eligible for Tax Exemption. This exemption is provided for a period of the initial three years. Also, any investment which is made by incubators of higher value than the market price is also exempted from Income Tax.

A tax holiday for three years means, the startup can completely utilize the revenues earned for their business development. - #15 Self-Certification under the Startup India scheme.

There are many labour law compliances that a business entity is required to comply with, as per the existing legal frameworks in India. Non-compliance with such laws due to ignorance or lack of resource leads to penalties & other legal risks for Startups. However, to reduce the regulatory burden, startups are allowed to self-certify compliance with respect to 9 (Nine) Labour and Environmental laws. In such a case, no inspection will be conducted for a period of three years.

- #14 Investment in Tax-saving Instruments.

To encourage saving by citizens, the government has provided certain tax deductions on the amounts invested in specified instruments under section 80C of the Income Tax Act. These are,

1. Employees Provident Fund (EPF).

2. Public Provident Fund (PPF).

3. Fixed deposits (Tenure of 5 years or more).

4. Life Insurance policies.

5. Equity Linked Mutual Funds.

6. National Pension Scheme (NPS) and other pension plans. - #13 Optimum Tax Planning by appropriate Salary Structure designing by Employer.

In case of a salaried individual, one can evaluate the salary structure offered by the employer and opt for those salary components which help maximise tax benefits. For example, one can opt for House Rent Allowance (HRA) in case they are paying rent, telephone/ internet expense reimbursements, education allowance, food coupons etc.

This helps the employees to claim optimum tax deductions/ tax exemptions while computing their taxable income (Subject to specified conditions). - #12 Increase in Retirement Fund Contribution.

Salaried individuals can look at making additional contribution towards 'Voluntary Provident Fund' in addition to EPF. However, if employee's own contribution to EPF and VPF exceeds Rs 2.5 lakhs in a financial year, Income Tax will be payable on the interest accrued on the excess provident fund contributions.

- #11 Importance of Filing Income Tax Returns within the specified timelines.

Income Tax Returns (ITRs) are considered as an important proof for various purposes like applying for immigration documents, Housing loans, Carry forward of losses, Certain high value transactions etc. Hence, It is very important to file Income Tax Returns and other Statutory Forms within the specified timelines to avoid interest/ penal implications and other inconveniences.

- #10 New Concessional Tax regime.

Subject to certain conditions, an individual or HUF will have the option to pay taxes at reduced slab rates, but, without certain exemptions and deductions. In view of the same, one can compare their tax liability under the existing and new tax regime and opt for the regime which is more beneficial from tax perspective.

- #9 Updated ITR filing after the end of Financial Year.

A new subsection is introduced in the Income Tax Act which allows the taxpayers to file an updated Income Tax Return for any errors or mistakes or omissions done while filing the Income Tax Returns upon payment of additional tax at 25% or 50%.

This Tax Return can be filed irrespective of whether an individual has filed an original/belated ITR for the respective year or not. - #8 Claim HRA as well as home loan benefits.

You can claim both HRA exemption, as well as, tax benefits on the interest paid on a home loan. The logic is that HRA is exempt if you are paying rent and home loan benefits apply only for a self-occupied house.

- #7 Unlimited deduction for your second home loan.

If you have more than one house, then any one is deemed to be rented out. So, the interest income on the home loan for that house can be claimed entirely for deduction, provided the rental income or a deemed income is charged to tax.

- #6 Disabilities can be tax savers.

If a taxpayer suffers from a disability, he/ she can claim deductions up to Rs 1,00,000 Under Section 80U. The dependent could include the taxpayer’s spouse, children, parents and even siblings.

- #5 Use education loan to lower tax.

If a parent or legal guardian takes a loan, he/ she can claim deduction for the interest paid, for up to eight successive years, starting from the year in which the interest was first paid.

- #4 Claim benefits for your political affiliations.

Any amount contributed to a recognized political party can be claimed as a deduction under Section 80GGC. The donation can also be made to the electoral trust which works for the purpose of conducting elections.

- #3 Pay lower tax if someone is ill.

The Income tax Act allows a taxpayer to claim a deduction of Rs 40,000 if he/ she has a dependent who suffers from any of the ailments specified under Section 80DDB. The deduction is higher at Rs 60,000 if the patient is a senior citizen.

- #2 Get Deduction for rent even without HRA

The house rent allowance is exempt from tax to a certain limit. But what if your salary does not include an HRA component or you are a self-employed professional or businessman? Under Section 80GG, you can claim deduction of the rent paid even if you don’t get HRA.

- #1 Use losses in stocks to cut tax

If you have made any long-term capital gains from sale of property, gold or debt funds, you can set them off against short-term capital losses made on stocks and bring down your tax liability. “Short term capital losses can be set off against both short-term capital gains as well as taxable long-term capital gains”